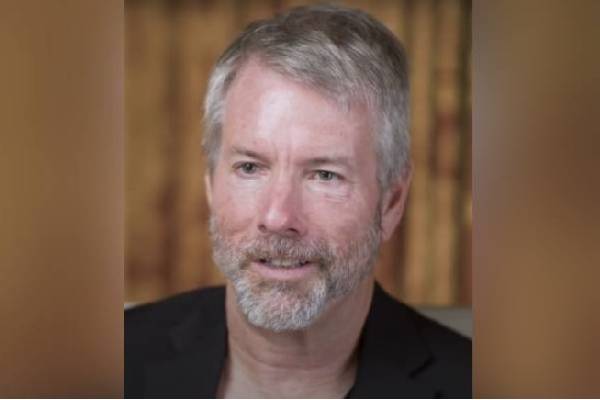

| Net Worth | $1.1 Billion |

| Born | February 4, 1965 |

| Gender | Male |

| Height | N/A |

| Country of Origin | America |

| Source of Wealth | Business |

Have you ever dreamt of being a billionaire? By following the lead of Michael Saylor‘s fortune, we came up with five reasons for the rapid rise in his riches.

In this blog, along with Michael Saylor’s net worth, we will also be discussing the five reasons that may boost your earnings, just like the billionaire’s fortune.

Investment As A Student

Michael Saylor is a well-known entrepreneur who is from a military family and grew up in Lincoln, Nebraska. As a result, the Air Force Reserve Officer Training Corps granted Mr. Saylor a full scholarship, allowing him to attend the Massachusetts Institute of Technology (MIT).

The investor actively participated in the Theta Delta Chi fraternity when he was a student there, and he was able to complete dual degrees in science, technology, and society and aeronautics/astronautics.

After learning about computer simulation technology at the MIT Sloan School of Management, Michael’s attention shifted to how it is used in company strategy and public policy formulation.

Later on, Saylor graduated from MIT with flying colors. Michael Saylor’s riches were surely paved by graduating from MIT with top honors.

Founding MicroStrategy

Saylor founded MicroStrategy with his MIT fraternity mate Sanju Bansal. The business first produced data mining software before concentrating on business intelligence solutions.

In June 1998, Saylor made his business accessible to the general public by issuing an initial stock of 4 million shares at a price of $12 each. The stock price soared by double on the first day. Records show that he has more than 39,521 firm shares worth more than $11,501,401 in total.

Saylor left his position as CEO of MicroStrategy on August 8, 2022. However, he remained in that position as executive chairman.

Saylor highlighted his wish to give Phong Le, the company’s president, more authority over business operations while focusing on the acquisition strategy for Bitcoin and advocacy work.

ALSO READ: Discover the spouse of successful trainer Kiaran McLaughlin

Crypto Investment’s Massive Role In Michael Saylor’s Net Worth of $1.1 B

During MicroStrategy‘s quarterly earnings conference call in July 2020, Saylor shared that the company was considering buying alternative assets such as Bitcoin or gold instead of keeping cash.

In August 2020, MicroStrategy used $250 million from its reserves to buy bitcoins. They had added another $650 million worth of Bitcoin to their portfolio till December 2020.

View this post on Instagram

During the course of the year 2020, the MIT topper guided Microstrategy towards investing company funds and taking out loans to acquire a total of 70,470 bitcoins worth $1.125 billion.

The whale shared in October 2020 that he personally purchased 17,732 bitcoins for $175 million. Thanks to making smart Bitcoin investments, Saylor has become a billionaire.

Similarly, like Michael Saylor’s net worth, you may be interested in Teitum Tuioti’s net worth.

40+ Patents Owner

Michael Saylor is more than just an investor in the crypto and business realm; he has also dedicated time to creating his own products, with a portfolio boasting over 40 patented inventions.

These patents are primarily applicable to the field of computer technology, where groundbreaking innovations can result in particularly valuable patents.

It follows that among this impressive collection, there are likely several patents contributing substantially to Michael Saylor’s earnings.

Beyond An Entrepreneur, A Writer

In addition to being a business, Michael Saylor is also a writer. The billionaire has written What is Money? The Saylor’s Series, Michael Saylor. On Bitcoin. The very first Interviews and The Mobile Wave: How Mobile Intelligence Will Change Everything.

The oldest and the most heard book of Saylor, The Mobile Wave, explores mobile technology trends and their potential impact on various industries such as healthcare, education, commerce, and developing nations.

It became a popular best-seller in the hardcover non-fiction books category by ranking number seven on New York Times Best Seller list for August of that year while also making it to the Wall Street Journal’s top-five list of hardcover business books for July 2012.

So, not just businesses and investments but the book published might have had an impact on Michael Saylor’s wealth. For better or for worst, let’s cheer him on for his future endeavors.